In a scene from the movie, Zindagi Na Milegi Dobara, the three holidaying friends are sitting in a charming bar in Barcelona. They have had a few refills of their beers.

While Abhay Deol heads to the bar to get shots for everyone, Farhan Akhtar asks Hrithik Roshan:

“Toh wohee plan, 40 tak note chaapo aur phir retirement”?

“ Same plan, mint money and retire at 40?”

Hrithik nods with smug certainty, “Yyup, that’s the plan”, and then steps out for his “conference call”.

Before you read further, here’s a quick test that might save you time.

Imagine this: A close friend calls you on a random Wednesday afternoon and says, “Let’s fly to Japan this weekend for sushi and cherry blossoms.”

No planning, no checking leave balances, no budgeting — just a spontaneous yes.

Can you do it without a second thought about work or finances?

If Yes — congratulations. Stay curious about the world, stay disease free, rest you should be ok. You can close this window.

If No — Read on

Financial Freedom

Most of the affluent to middle-class are checked-in to a routine of a job or a middling business. The calculus is simple — trade off the now for a secure, idyllic future.

The scene from the movie I described above plays out routinely. A bunch of old-time friends, office colleagues go on a weekend trip. They are hanging out by the poolside. Dark rum and diluted whiskey is being poured.

One of them leans back in his chair, glass in hand, and asks,

“So…what’s the plan for the future?”

Someone else confidently replies,

“X million, and then I retire.”

It is understood that till 'X is achieved, you have to bide your time, make yourself go through the grind of daily commerce.

X is the number that, if sitting in your account, would comfortably cover all your realistic material needs for life.

Of course, X changes from person to person. For instance, if you have a taste for private jets, then your X would swell up dramatically. No judgement.

How does one arrive at X?

You can either guess your X intuitively or calculate it methodically. Both will probably land in the same range.

This is a popular topic for content among personal finance gurus, especially on youtube.

I will try and simplify this as much as possible. Even then some might be put off. But bear with me.

Say, you’re 40 and hope to live until 90 (a fair expectation).

You need to estimate your total expenses over the next 50 years. Not as difficult as it sounds.

Add all scheduled expenses — rent, mortgage, shopping, tech upgrades, vacations, grocery etc.

Add up all the big life expenses, milestones — kids’ college, weddings, a round the world trip, private jet?

Factor in inflation (eg. rent increases 10% every year)

Here’s an excel template you can use

Say your estimated lifetime expenses over 50 years come to ₹100. But because money grows when invested, you don’t need the full ₹100 today.

Compute the Net Present Value (NPV) i.e. the amount you need today, if invested with minimal risk, to cover those future costs.

If the risk-free rate at which you invest is 10%, that ₹100 shrinks to just ₹19.83 today (Hope I got the math right).

You need that amount in your account today to meet your financial commitments for the rest of your life.

₹19.83 is your ‘X’, the silver bullet for all the choices you make in life.

But we’ve got a problem here…

The problem with X

Your X is likely wrong.

Which means, you would be spending the most productive years of your life chasing a number that’s wrong.

I am not trying to make a stale point here. That how the roof above us could cave any moment. That ‘life is short’. That ‘money doesn’t matter as much as we think it does’. And that it’s important to ‘live in the moment’.

These are truisms, and useful ways to think about the world. But not for this post.

My point is that there are, in fact, technical errors with the number X.

X is based on wrong assumptions about the world. The assumption that the world is static, and the rules of engaging with it remain constant.

There are two kinds of errors here:

1. The Future-Proofing Fallacy

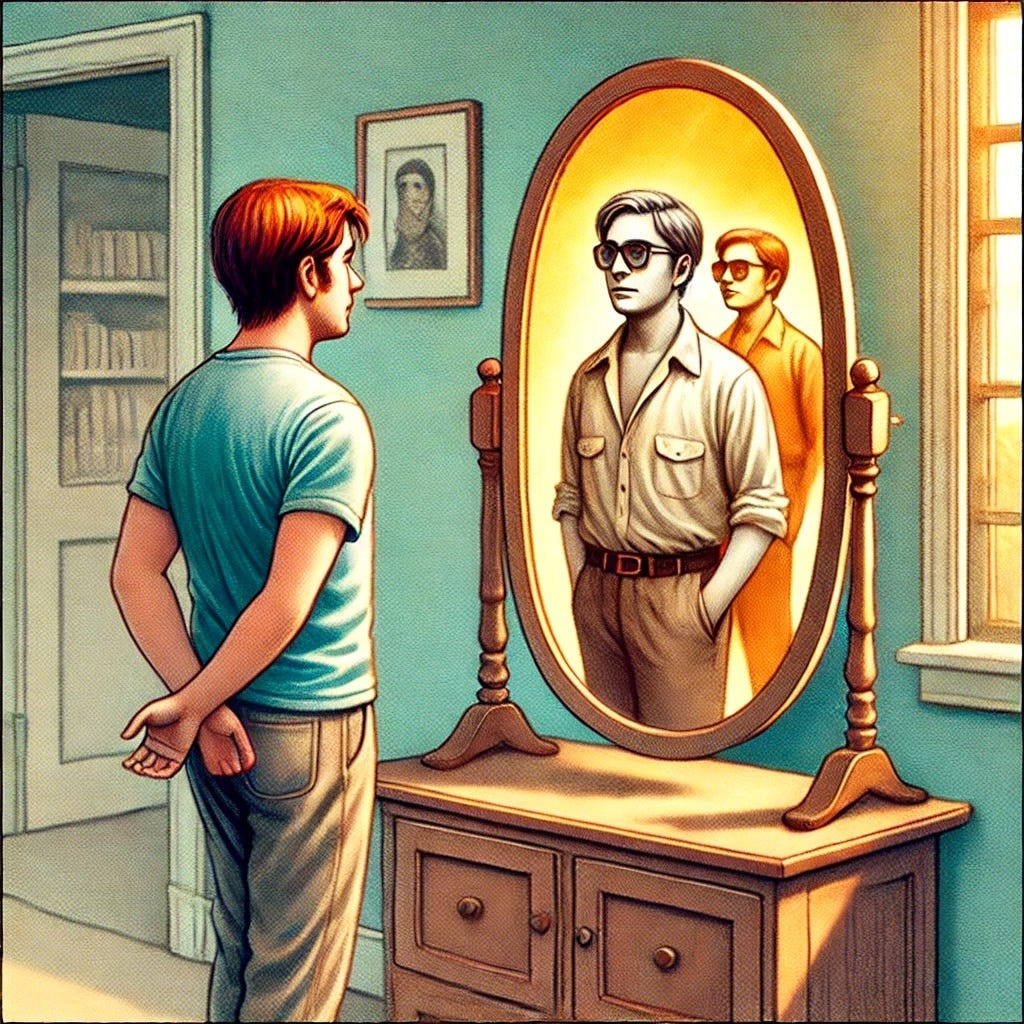

2. The Stranger-in-the-Mirror effect

I just coined these for simplicity.

The Future-Proofing Fallacy

Imagine you were trying to compute your X in the year 1900. What is the basket of goods you would have listed in your expense sheet?

Horses, Letter and Postage Stamps, Gas Lamps?

Say, in 2025, buying a private jet is your key life goal.

But what if the private jet, in whose pursuit you shaped the prime years of your life (private jet at current prices ain’t cheap, especially if you’re exploring the Gulfstream G800), is replaced by cheap long distance Chinese drones.

Wouldn’t that be a waste of a life?

Forecasting a basket of goods into the future based on our current understanding of the world is bound to be wrong.

Price Gains

Consider the phone in your hand. Its current specs — processor speed, memory, the display resolution, the camera — the absolute top of the line stuff (iphone?) costs you about $2000.

If we had to build a phone with the exact same specs just 20 years back, it would have cost us between $100 Million - $300 Million. Yes!

Even high-end government / military supercomputers in 2005 wouldn’t match the raw processing power of today’s $1,000 smartphones.

We factor in inflation, but we rarely account for technological deflation — the way advancements slash costs over time. The price gains are just too dramatic, to plot into a linear excel model.

How much does a private jet that you desire cost today? 50 Million, 100 million? Similar to what our current smartphone would have cost couple decades back.

Everyday anyways feels like we are getting ever so closer to the Jetsons

What would you predict now in 2025 that would go obsolete in 2050?

This phenomena plays out (or will play out) in every field.

Take education. The million dollars that you would set aside for your child’s college might be unnecessary. The marginal cost of learning is almost coming to zero. If you have a child born today, my prediction is, she is unlikely to go to a university in the traditional form we recognize today.

The world has changed more in the past 50 years than in all of humanity preceding it. And it’s going to change more in the next 10 years, than the preceding 50.

There is that old Lenin saying, “there are decades where nothing happens; and there are weeks where decades happen". Right now, it feels like decades keep happening every week.

We struggle with exponential thinking and find it hard to grasp massive, rapid changes of any kind. For 99% of our existence, change was slow and incremental, with much of life spend staring at the African prairie and fending off wild animals. Our adaptive brain has a lot of catching up to do.

So, to apply frames and understanding of today’s world into the future is bound to leave us with ideas and approaches that would become obsolete.

The Stranger-in-the-Mirror effect

In 10 or 20 years, you’ll be a different person, with different values. Even if technology stood still, you wouldn’t.

That is true even if we pause all progress right this moment.

We evolve. We start seeking meaning in other things. Our choices and preferences are in constant motion. In 10 years, you’d probably care about a year long sabbatical at a homestay in the hills than a shiny new car.

You drive a Mercedes now and you build in a Rolls Royce expense into your ‘X’ for 10 years later. 10 years pass. You realize you actually don’t care about the Rolls Royce at all. With some self-reflection, even the Mercedes seems silly. The ‘hedonic adaptation’ sets in very quickly.

Point is, the 40-year-old you is chasing dreams the 50-year-old you might not be grateful for.

PS: This isn’t true for all. For some, the hedonic treadmill never runs out of juice. Therefore, this post isn’t for everyone either.

Are you going to live till 90?

The assumption of your 90 year old life isn’t certain either.

Futurist Ray Kurzweil in his book ‘Singularity’ predicts the first 1,000-year-old human is already alive. Are you going to be one of them? Did you plan for 900 extra years in your Excel sheet?

With advances in longevity and medical sciences, you might be condemned to live for much longer than you put in that excel.

So your carefully crafted X could leave you broke and old. That would suck.

So, what should we do?

Sure, engage in financial planning. Be prudent with your finances. This post isn’t meant to dissuade anyone from it.

But be aware of the fallacies of single-minded pursuit of an error prone number.

I recently read the book ‘How Will You Measure Your Life’ by Clayton Christensen. Here’s an excerpt:

The theory of motivation suggests that you need to ask yourself a different set of questions than most of us are used to asking

Is this work meaningful to me. Is this job going to give me a chance to develop? Am I going to learn new things? Will I have an opportunity for recognition and achievement? These are the things that will truly motivate you. Once you get this right, the more measurable aspects of your job will fade in importance.

..expecting to have a clear vision of where your life will take you is just wasting time. Even worse, it may actually close your mind to unexpected opportunities.

While you are still figuring out your career, you should keep the aperture of your life wide open.

The world is evolving—so should our plans. We would do good by not chasing a static number in a dynamic world.

We all are bound to be wrong, because it’s impossible to keep pace with developments across fields, and synthesize them all together.

But knowing that we don’t know enough is a good starting point, instead of having some outdated mechanism to design our life.

As the saying goes, "Not everything worthwhile can be measured, and not everything that can be measured is worthwhile."